Financial markets are now in sharp decline after China hit back at the United States in response to the tariffs announced by Donald Trump on Wednesday night.

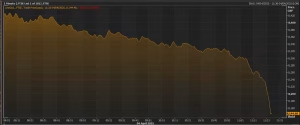

In London, the FTSE 100 has dropped 313 points, or 3.7%, since the market opened, falling to 8,173 points—its steepest one-day fall since March 2023.

As the chart below illustrates, the selloff has accelerated in recent minutes:

The market selloff deepened after China’s finance ministry announced plans to impose an additional 34% tariff on all U.S. goods starting April 10. This move is in direct retaliation to the sweeping tariffs introduced by the U.S.

In a statement, China’s State Council Tariff Commission said:

“This practice of the US is not in line with international trade rules, seriously undermines China’s legitimate rights and interests, and is a typical unilateral bullying practice.”

In London, banks are bearing the brunt of the decline. Barclays shares have slumped 10%, while NatWest is down 9.5%.

Rolls-Royce, the jet engine manufacturer, has plunged 12%.

Concerns over a potential global economic slowdown are also weighing heavily on mining stocks, with Glencore falling 8.7%.